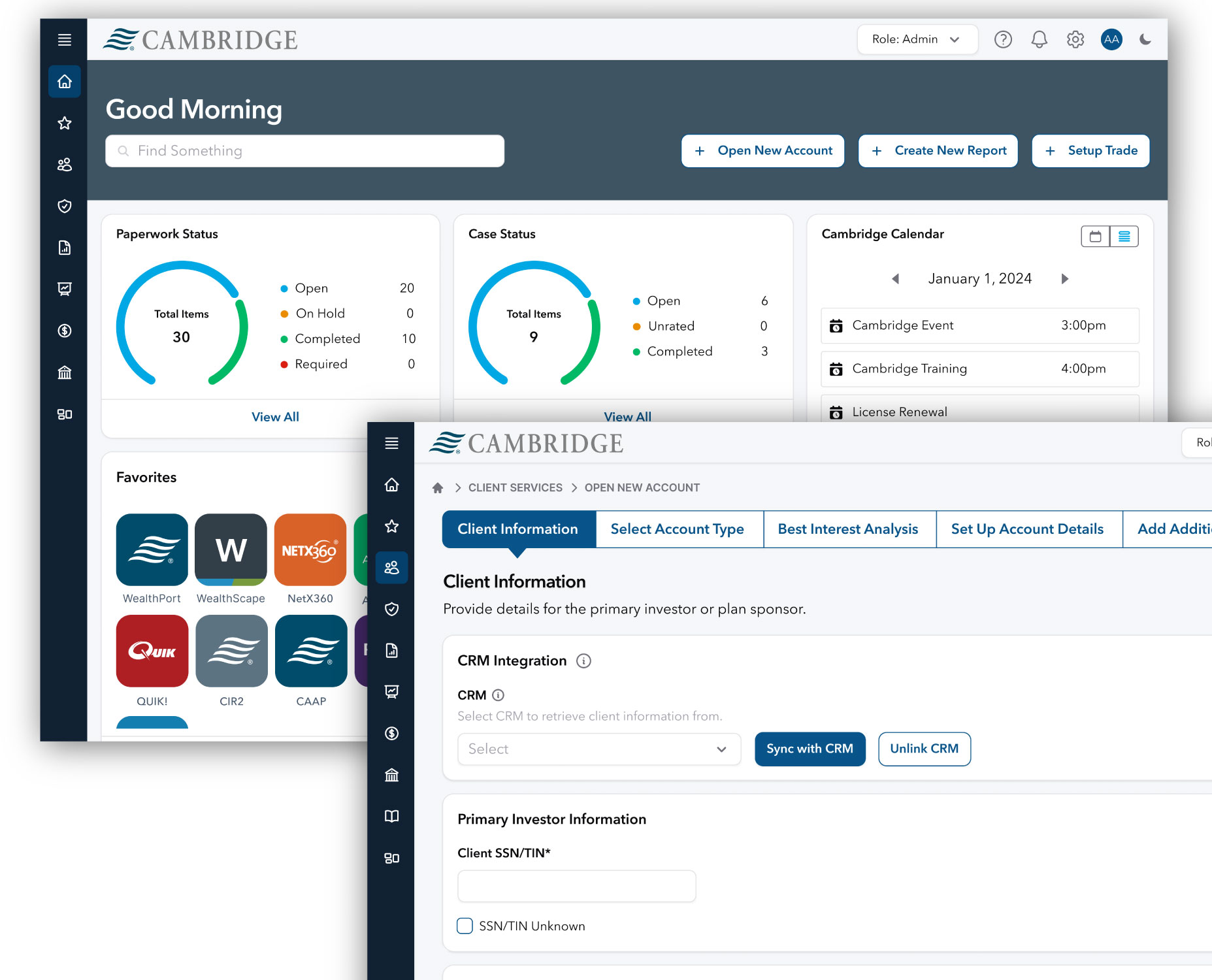

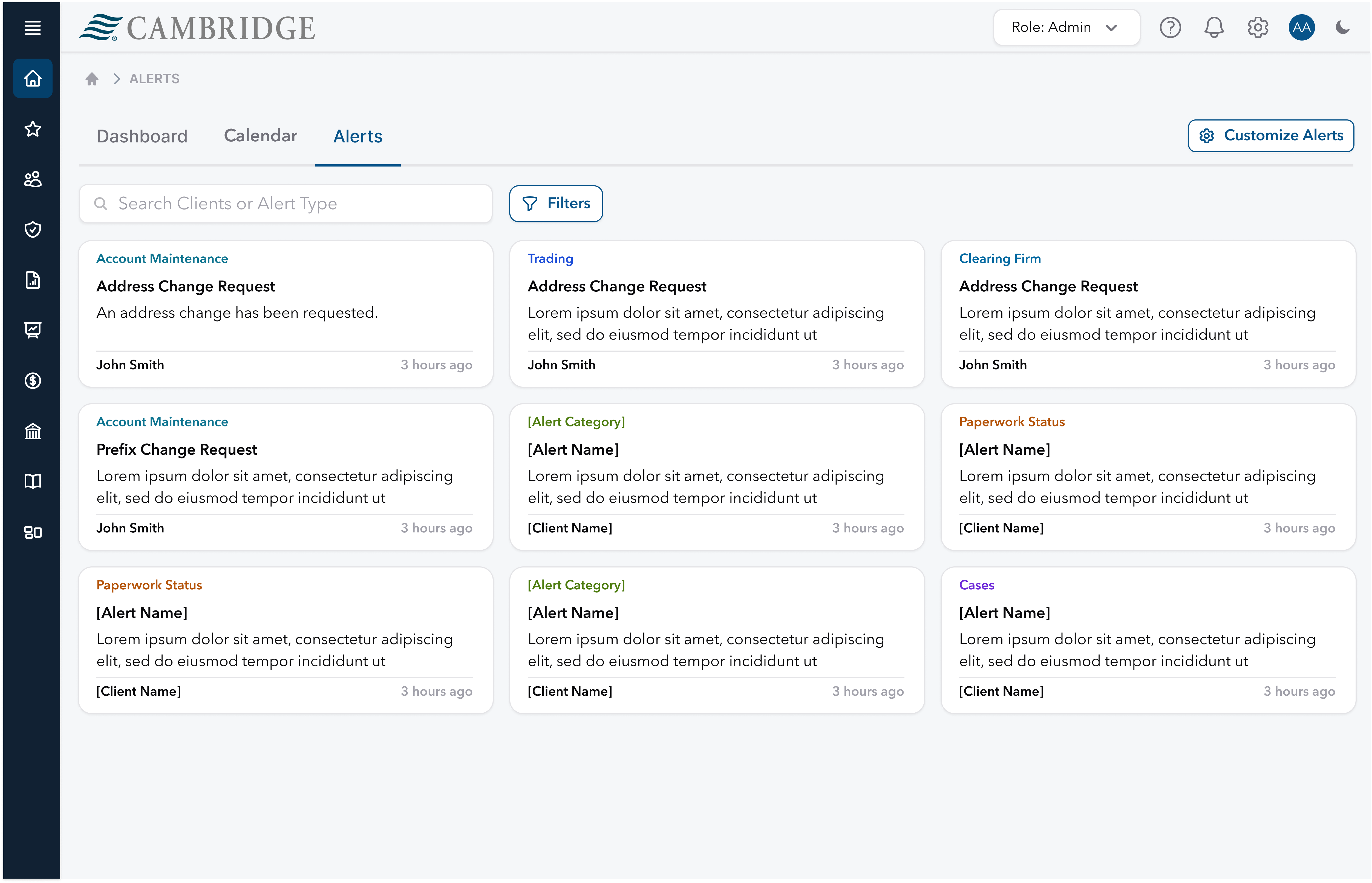

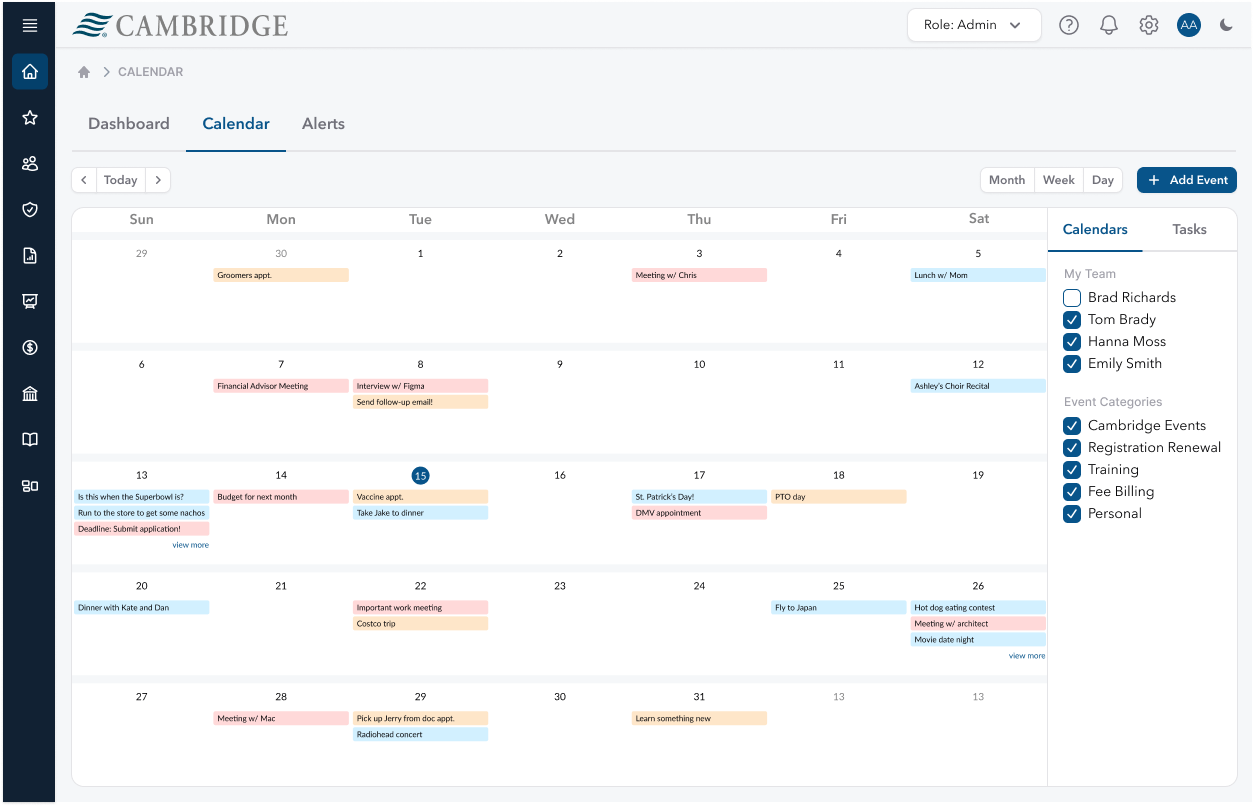

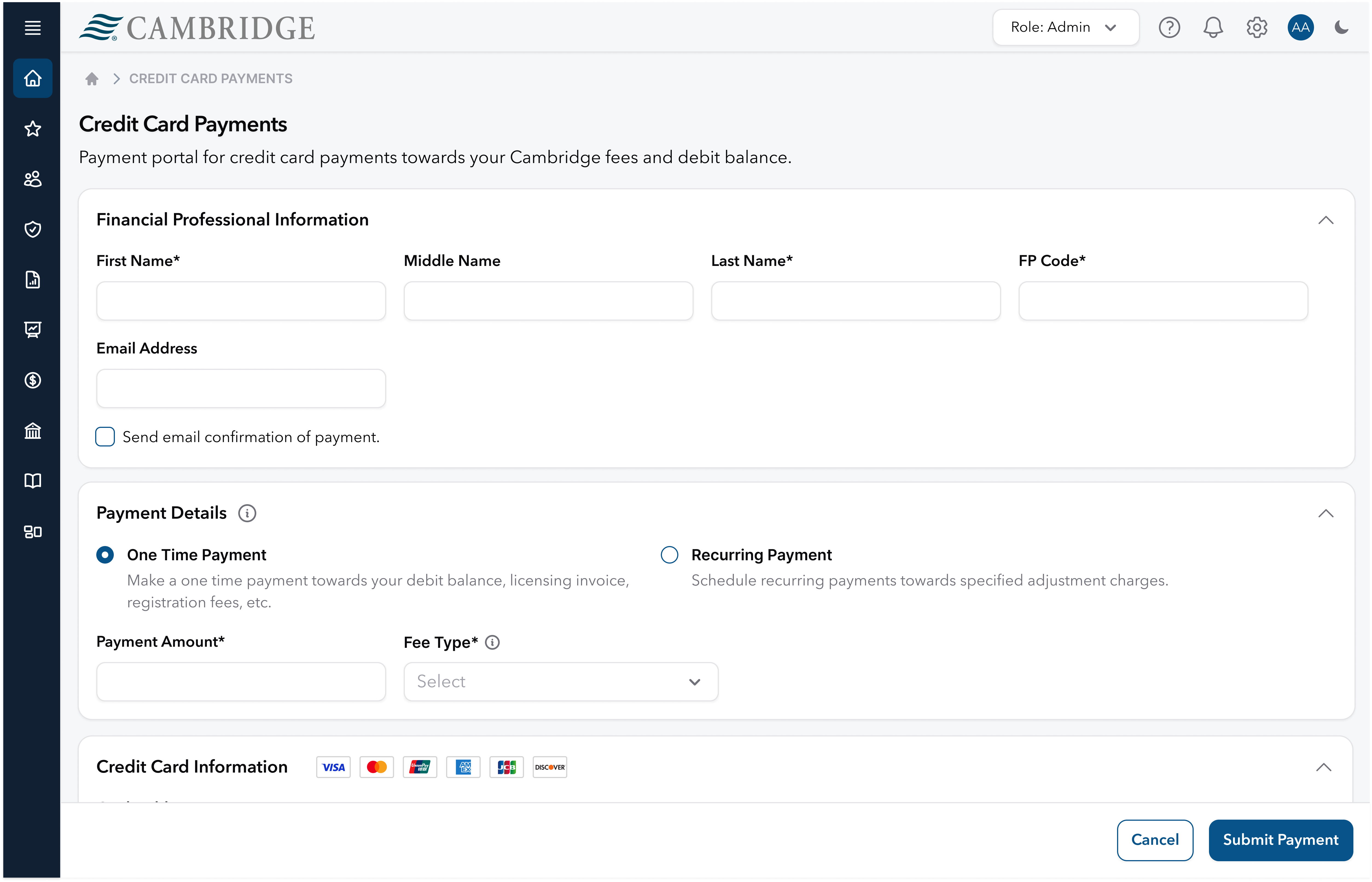

Advisor Workstation: Powering Efficiency for Independent Financial Experts

Product strategy and delivery

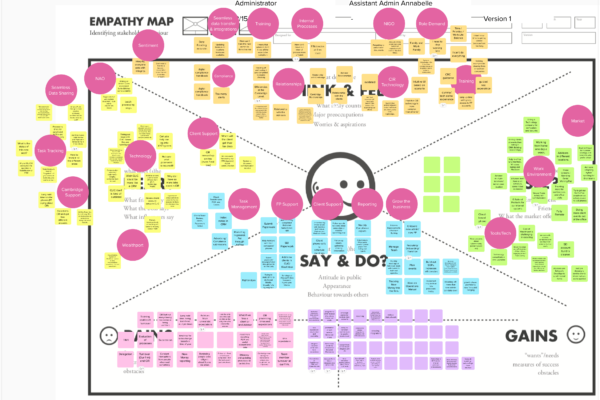

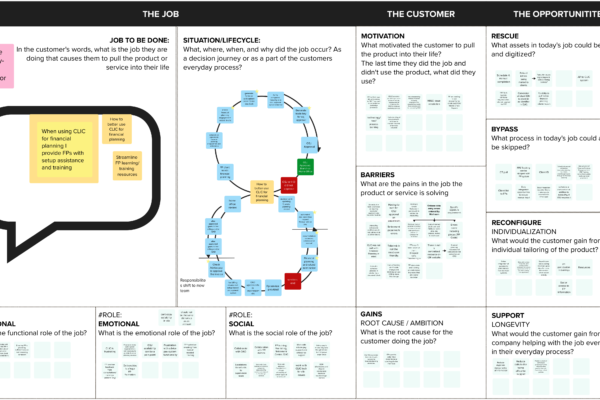

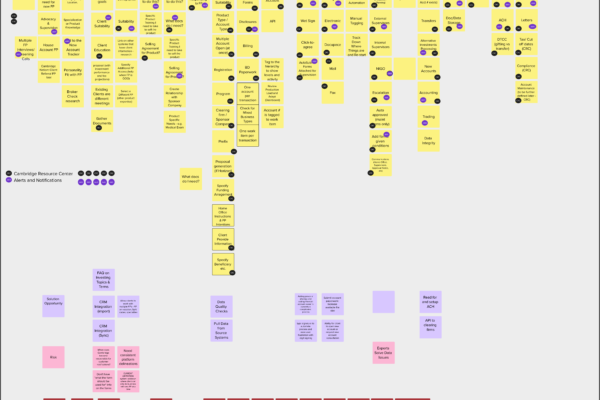

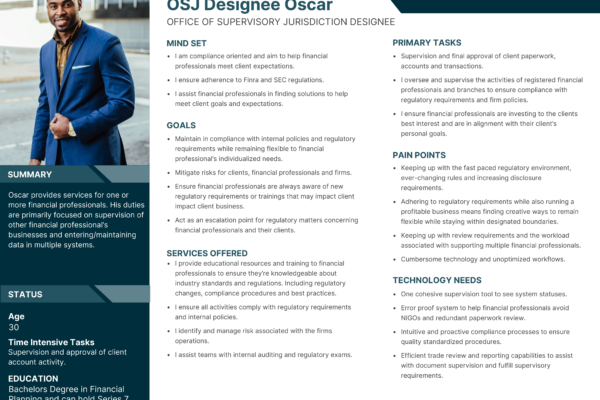

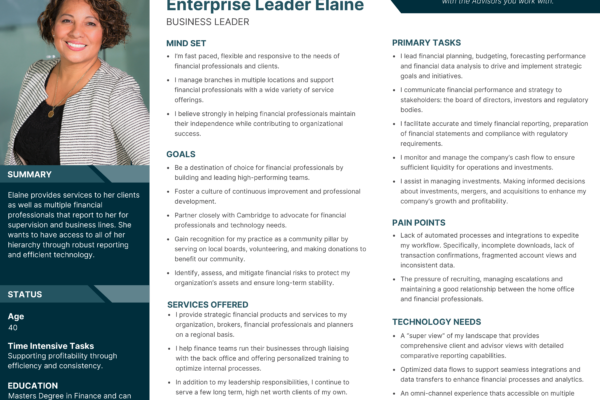

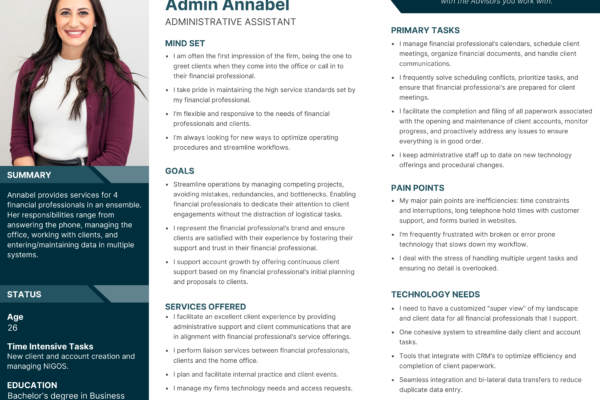

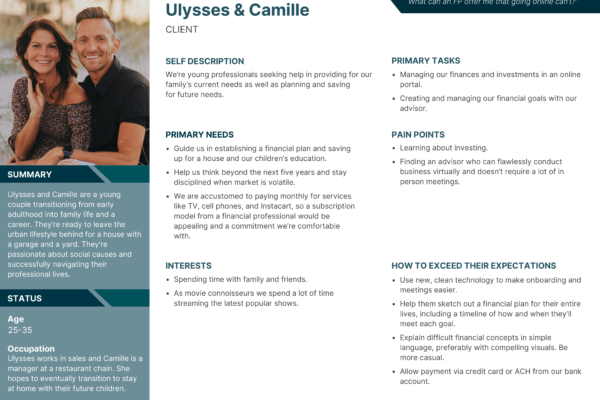

The digital experience for independent advisors needed more than just a transformation—it required a solution built around their unique needs and the power of partnership. The Advisor Workstation was designed as a unified, user-focused platform to streamline processes, reduce manual tasks, and enhance operational efficiency. By aligning digital workflows with real-life scenarios, it not only simplifies daily tasks but also strengthens the advisor-broker dealer relationship, reinforcing trust and delivering an unparalleled support experience.